A Tale of Two Incretins

The science, promise and clinical development of GLP-1 and GIP receptor agonists in obesity

Table of Contents

1. Introduction

When a prescription medication is “trending” on social media sites like TikTok—you either have a blockbuster drug on hand or a storm of medical misinformation. Quite possibly both.

Wegovy, Ozempic, Mounjaro, weight loss pills, “GLP-1s”, incretins—these terms are used interchangeably (and often incorrectly) to describe a class of medications approved to treat diabetes and, more recently, obesity. Hailed by some as the “next statins'' that will save millions, and by others as potentially “dangerous” drugs—ruinous to our health and wallets—one point is certain: there is much to discuss concerning the clinical use and affordability of these medications. These conversations will no doubt consume TikTok and the medical community alike in the coming years.

Yet buried in the hype and hearsay surrounding these drugs, is a beautiful scientific story. One conceived in the wake of recombinant DNA technology in the ‘70s, shaped by early anglerfish experiments in the ‘80s, and given further structure by elegant biochemical studies of GPCR signaling in the ‘90s. Subsequent physiology experiments and development of the first FDA-approved GLP-1/2 agonists contribute to this tale’s “rising action.” Nearly 40 years after GLP-1 and GIP were first cloned, our saga appears to be reaching its climax, as medications like Wegovy and Mounjaro are poised to become blockbuster treatments for obesity.

How do GLP-1 drugs work to combat obesity? What are the key, highly anticipated readouts in ongoing obesity and cardiovascular outcomes trials? Where is the “bar” set for newer medications? How will these drugs be integrated into our healthcare system, and what factors will facilitate widespread adoption? The landscape for GLP-1 and GIP receptor agonists is fast becoming crowded. Which differentiating factors will enable specific companies and drugs to capture this market (and potentially $100B in upside)?

Perhaps most importantly: what are the key learnings for science and medicine embedded in this sprawling saga? How can these takeaways inform the efficacy of novel drug development efforts in 2023? In discussing these drugs, there is a lot on our plate. We will begin with an amuse-bouche of GI physiology, incretin biology and diabetes. Let’s dig in.

2. Got GLP-1?

Discovery and characterization of the incretin hormones

Trust your gut. In addition to life-sustaining nutrient absorption and excretion, our intestines wield many responsibilities--chief amongst them include regulating pancreatic and stomach secretions, metabolism, nervous system function and behavior (Figure 1). But how does this winding “food tube” exert such profound effects on physiology?

The answer starts with observations made by Bayliss and Starling in 1902--the duo ground up intestinal tissue, and administered these crude “extracts” to animals. They observed a “reflexive” pancreatic secretion and subsequent lowering of blood sugar (glucose). The implications of this simple experiment are profound: cells in the small intestine can secrete factors (named “hormones” in 1905) that regulate pancreatic function and glucose metabolism. Bayliss and Starling termed these factors “secretins”—though they failed to isolate these hormones individually. After the discovery of insulin (1921), these gut hormones were renamed “incretins”— for their ability to respond to oral glucose and augment insulin secretion. Twentieth century advances in peptide biochemistry and protein sequencing enabled John Brown to purify the first incretin, named GIP, in the 1970s. He demonstrated GIP’s ability to lower blood glucose by promoting insulin release from the pancreas in animals and humans.

Yet protein purification and sequencing is a lengthy process—biochemical isolations from gut tissue also yield relatively small amounts of protein, making it difficult to study the function of these molecules in the lab. Enter recombinant DNA technology—pioneered by Stanley Cohen, Paul Berg and Herb Boyer in the 1970s. RNA could now be rapidly isolated from intestinal cells, transcribed into recombinant “cDNA” and then “cloned” into a circular DNA plasmid. From the DNA sequence of this “cloned gene” one could i) predict the final amino acid protein sequence ii) produce large amounts of recombinant protein in the lab and iii) more easily study protein function—by “transfecting” the recombinant gene into cells or administering exogenous protein to tissue cultures or animals.

The Habener lab utilized these molecular cloning techniques to isolate cDNAs from anglerfish in the early 1980s. Habener and colleagues started studying a particular cDNA that encoded several products: glucagon and a smaller glucagon-related sequence, resembling GIP. Graeme Bell and others went on to clone mammalian versions of “preproglucagon”: a gene that encodes a large protein precursor, which is cleaved to produce glucagon and two glucagon-like peptides (GLP-1 and -2). The amino acid sequence of the GLP-1 protein, though absent in anglerfish, was highly conserved across mammalian species--hinting at its fundamental role in physiology.

We are now in the early 1980s—recombinant DNA technology has enabled molecular cloning of GLP-1 and GLP-2. But how are these peptides liberated from the large preproglucagon molecule? What does the evolutionarily conserved GLP-1 peptide do when produced in intestinal tissue?

We noticed that for GLP-1 there were multiple immunoreactive forms of different sizes….in our second paper we used these smaller peptides to show that GLP-1 stimulates insulin gene expression and secretion from pancreatic islets. — Dr. Daniel Drucker [Biomarker April 2023]

Fresh out of medical school, a newly minted Dr. Daniel Drucker joined the Habener laboratory in 1984. Assigned to tackle these questions, Drucker made a profound discovery: different organs processed proglucagon…well, differently. In the pancreas, proglucagon was cleaved to produce glucagon and a large protein called MPGF. However gut cells are decidedly more “snippety”: they cut the precursor to produce a series of small peptides: GLP-1, GLP-2 and others (IP-2, glicentin, and oxyntomodulin). Other cells, such as fibroblasts, were found to leave the proglucagon precursor entirely intact. Consider the implications of this work: a large precursor protein is processed in a cell type-specific fashion, leading to the production of several smaller peptide hormones. But why? What specific functions are these different proteins performing?

The stage was set for Habener, Drucker, Svetlana Mosjov, Lise Heding, Jens Holst, Michael Nauck, and many others, to elucidate the function of GLP-1 in cells, lab animals, and humans. Collectively they found that a truncated form of GLP-1 produced by gut cells was able to bind a G-protein coupled receptor (GPCR) expressed on pancreatic islet cells and in other tissues. In the pancreas, GLP-1 peptides boost insulin secretion and suppress production of glucagon. Importantly, as blood glucose levels dropped, so too did the ability of GLP-1 to stimulate further insulin release—limiting the potential for dangerous hypoglycemia (drop in blood glucose). The GLP-1 receptor (GLP-1R) is widely expressed in other tissues. Thus GLP-1 was shown to regulate a number of diverse functions: reduction in digestive enzyme secretion, slowing of gastric motility, increases in heart rate and blood flow, increased bone remodeling, and suppression of appetite (via hypothalamic and brainstem nuclei). The dramatic weight-loss properties of current medications are largely attributed to GLP-1 agonism in these brain regions, to increase feelings of satiety and reduce food intake.

The potential for GLP-1 agonists to treat disorders like type-2 diabetes (T2D) was not lost on the endocrinology community (Reviewed here). Nauck and colleagues (1993) showed that GLP-1 infusion normalized elevated fasting glucose levels in T2D patients (via enhanced insulin secretion). Yet subcutaneous injections of recombinant GLP-1 were a disappointment in patients, falling short of prior results with intravenous GLP-1. Studies by Kiel, Holst and Deacon uncovered that GLP-1 is rapidly degraded by an enzyme called DPP-4. GLP-1 injected subcutaneously simply took too long to reach receptors on target tissues—DPP-4 degraded the peptide within minutes. Yet by 2000, a strategy had emerged to prolong the effect of GLP-1 signaling: generate DPP-4 resistant peptides that bind and activate (i.e., agonize) GLP-1R. It is by no means an overstatement to say that this approach was wildly successful in unlocking GLP-1’s therapeutic potential.

Therapeutic translation of GLP1 receptor agonists

In 1992, John Eng isolated exendin--a small peptide encoded within the Heloderma lizard’s proglucagon gene. Normally produced in the lizard salivary gland, exendin can bind mammalian GLP-1R and bolster its activity. Though this peptide structurally resembles GLP-1, and is encoded by proglucagon, crucially, it is resistant to DPP-4 mediated breakdown (Figure 2). Exendin-4 (exenatide) became the first clinically-approved GLP-1R agonist (2005) for treatment of T2D. A once-weekly formulation was later approved for diabetes in 2012.

Since 2005, multiple GLP-1R agonists resembling exendin-4 have been developed (Figure 2), with fatty-acid modifications to increase half-life and facilitate less frequent dosing regimes. After observing weight-loss in T2D patients, a once-daily injection of liraglutide (Novo Nordisk’s Saxenda) was approved for obesity in 2014. Novo Nordisk went on to develop the longer-lasting semaglutide (Ozempic): a once-weekly injection that was approved for treatment of T2D in 2017. Novo also created an oral formulation of semaglutide (Rybelsus), which was also approved for T2D. Collectively, these trials demonstrated convincing glycemic control in diabetics. In 2021, a higher dose (2.4 mg) once-weekly formulation of semaglutide (branded Wegovy), was approved for obesity. In parallel, Eli Lilly developed tirzepatide (Mounjaro)--a dual GLP-1 and GIP receptor agonist. Tirzepatide was FDA-approved for T2D in 2022, and showed impressive weight reductions in subsequent obesity trials. After being granted a fast-track designation for weight loss by the FDA (October ‘22), tirzepatide is expected to be approved for obesity later this year.

In the below sections, we will explore the details: exact formulations, trial readouts, degree of weight loss observed in pivotal and ongoing trials. But before diving into trial results for past and present obesity medications, it is interesting to consider: what are the remaining questions in GLP-1 and GIP biology in 2023?

Looking forwards: future avenues of research for incretin biology

Several factors hampered (and continue to challenge) clinical development of GLP agonist therapies. Small peptides like GLP-1 and GLP-2 are rapidly cleared in vivo, leading to low circulating levels. More reliable detection reagents would facilitate both the basic study of this axis as well as clinical development--advances in antibody and peptide generation (such as those employed by the Institute for Protein Innovation) will hopefully be leveraged to improve sensitivity and specificity of clinical assays. Small molecule GLP-1 agonists and antagonists (such as those in development at Structure Therapeutics) may facilitate study of endogenous GLPs activity and increase clinical uptake in T2D and obesity patients. AI-enabled in silico approaches, in tandem with high-throughput target binding assays (e.g., small-molecule microarrays) and phenotypic screens (perhaps using cAMP+ as a readout), may further uncover some of these incredibly useful molecules.

Single-cell, ‘omics studies of human L-cells, which secrete GLP-1 and 2, may uncover regulatory networks controlling incretin secretion. Crosstalk between immune cells, the enteric nervous system, L-cells, and other enteroendocrine subtypes is an area of physiology ripe for discovery. GLP-1 drugs are currently in trials for several indications, including Phase 3 studies for non-alcoholic steatohepatitis (NASH). Patients taking GLP-1RA display reduced fibrosis and improvement in NASH clinical scoring. Yet GLP-1 receptors are not expressed on liver cells, suggesting that the drugs have an indirect effect: “There are no GLP-1 receptors expressed in hepatocytes. This is a general theme in space: often, we don't find a lot of GLP-1R in places that we know are affected. It is likely that there is inter-organ communication involving the nervous system,” suggests Dr. Drucker. Using chemogenetic, optogenetic, and viral tracing strategies to study how GLP-1 signals in the brain impact liver fibrosis and inflammation is an area of intense basic investigation. Such work could one-day enable development of “secretagogues” that promote release of endogenous GLPs from human L-cells. Such molecules could have therapeutic potential for T2D, obesity, cardiovascular disease and even neurodegeneration.

We don't yet understand how these drugs truly work… What's the mechanism for the benefits of GLP-1 in the heart, liver or brain? I would say to you humbly, that nobody knows…mechanistically, there is quite a bit to do so that we can make the next-generation better. — Dr. Daniel Drucker [Biomarker April 2023]

3. Drugs of epic proportion

“Begin at the beginning," commands the King to the White Rabbit in Carroll’s Alice in Wonderland. Good advice when trying to understand evidence in a trial--of either fantastical or clinical variety. What has historically been attempted to treat obesity? Based on prior trial data, how should we benchmark current obesity drugs—where is the bar set? What do clinicians, the FDA and investors view as “success” in this space? In this section we will review past and present GLP-1RA data, so that we are better able to come to a verdict on future trial readouts.

The history of medical therapy in obesity has been frustrating: many treatments were not effective at all. Several drugs were withdrawn from the market because they were ultimately not safe. This has engendered a degree of mistrust by clinicians….we have an 18-year track record of clinical safety with GLP-1 drugs. Nonetheless, there is a cloud over the obesity field. — Daniel Drucker [Biomarker April 2023]

Early Days of Weight Loss Therapies

In the late 1800s, thyroid extract was used to speed up metabolism and induce weight loss. Yet putting patients into a “hyperthyroid” state has consequences--often producing dangerous increases in heart rate, body temperature and blood pressure. Weight-loss medications in the 20th century proved to be equally dangerous: dinitrophenol, a mitochondrial proton pump uncoupler, was remarkably effective at shedding pounds but led to nerve malfunction and arrhythmia induced fatalities. In the 1950s, disastrous rainbow pills (combinations of amphetamine, digitalis, and diuretics) could be found in households across the world. “Anorectics,” medications designed to suppress appetite, like fen-phen (serotonin releasing agent) were commercialized, but eventually withdrawn from the market (1997) after they were found to cause valvular disease and pulmonary hypertension. From 2008-2010, Sanofi-Aventis’ Acomplia (selective CB1 antagonist) and Abbott Laboratories’ Meridia (NE/5-HT reuptake inhibitor)--both also designed to suppress appetite--were pulled from the market over similar cardiac safety concerns.

While 20th century medical solutions for weight loss were marred by withdrawals, failures and death, surgical methods found success. Bariatric surgery--which seeks to reduce the size of the stomach or bypass part of the GI tract--was conceived in the 1960s when surgeons observed that gastric cancer patients who had part of the stomach removed (subtotal gastrectomy) went on to lose weight. A large prospective cohort study that tracked over 1,700 patients demonstrated that patients who underwent a Roux-en-Y gastric bypass lost an excess 21% of their body mass normalized to their non-surgical matched controls at the 10 year point (corresponding to 35 kg (~77 lbs) greater weight loss). The SLEEVEPASS trial demonstrated that patients who were randomly assigned to either a laparoscopy sleeve gastrectomy or a laparoscopic Roux-en-Y gastric bypass maintained a 43.5% and 50.7% excess weight loss a decade after the procedure.

Bariatric surgery patients also have improved health outcomes: a recent retrospective cohort study demonstrated that the incidence of extended major adverse cardiovascular events was 8% lower in patients with established cardiovascular disease who received bariatric surgery compared to their age, sex, and history matched control. Another study compared 985 patients who underwent bariatric surgery to matched control with a BMI > 40. Bariatric surgery was associated with a 58% lower risk of eGFR decline >30% and a 57% lower risk of doubling serum creatinine or ESRD. This association was similar among patients without reduced GFR at baseline, hypertension and diabetes.

Though remarkably effective, bariatric surgery carries the limitations inherent to any invasive procedure (surgical complications, cost, access): it is hard to imagine tens of millions of obese individuals going under the knife each year. Indeed, adoption of the procedure in the US is low. Among patients who meet the BMI criteria for bariatric surgery, utilization remains about 1%. There are about 250,000 bariatric surgeries performed each year in the US, and 15% of these are revisions of prior procedures.

There is a tremendous need for medical therapies that could reach high numbers of obese patients. Perhaps GLP-1 receptor agonists fit the bill as the long awaited holy grail for interventional weight loss.

Novo Nordisk dominates the GLP-1 market… for now

Since 2005, there have been 8 different non-insulin combined formulations of GLP-1 receptor agonists (Table 1). In early trials of exenatide and liraglutide in Type 2 diabetes (T2D), these agents uniformly led to weight loss. Over time, this became an appreciated feature of GLP-1 RAs and was mentioned in direct-to-consumer advertising to patients with T2D.

It was almost a decade after the first approval in T2D, before GLP-analogs picked up a second indication in obesity. Novo Nordisk was the pioneer--winning a 2014 FDA-approval for liraglutide (Saxenda) as an obesity treatment, formulated as a once-daily subcutaneous injection. In the SCALE trial, patients receiving liraglutide lost an average 5.6 kg (~12 lbs) more than patients receiving placebo, which translated to a 5.4% body weight loss over the course of 56 weeks (NCT01272219).

In 2008, Novo Nordisk began testing a newer formulation of the GLP-1 analog, semaglutide against liraglutide. Semaglutide has a half-life of one week compared to liraglutide’s 13 hours, allowing for once-weekly (instead of daily) injections. In a Phase 2 trial for T2D, weekly semaglutide was more effective at reducing HbA1c than daily liraglutide (NCT00696657). The longer-lasting product was first approved in 2017 under the brand name Ozempic. Pivoting back to the obesity space, a year-long Phase 2 study comparing semaglutide daily to 0.6 mg of liraglutide daily and placebo demonstrated the superiority of semaglutide over liraglutide in all doses above 0.2 mg (NCT02453711). Once-weekly 2.4mg semaglutide led to a 12.7 kg (~28 lb) weight loss over placebo in the pivotal Phase 3 trial (NCT03548935). This doubles the weight loss effects seen in the initial liraglutide trials (2014), suggesting that dosing regimens may be key to effective treatment (and differ from those used in T2D).

Perhaps the biggest splash to the GLP-RA pool has come with the PIONEER trials for oral semaglutide. This formulation includes a small fatty acid permeation enhancer, SNAC, that promotes absorption of semaglutide across the stomach mucosa and into systemic circulation. Novo Nordisk earned approval for a daily oral version of semaglutide (Rybelsus) in T2D (NCT02906930). With a more convenient oral formulation, Novo can position itself as a competitor to traditional diabetes medications, such as metformin, sulfonylureas, and SGLT2 inhibitors that are taken by mouth. The PIONEER-4 trial demonstrated the superiority of oral semaglutide compared to daily liraglutide in T2D; however, clinical trials assessing the efficacy of oral semaglutide (Rybelsus) in obesity are still enrolling participants (NCT05442450).

Victoza, Saxenda, Ozempic, Wegovy, Rybelsus… it’s not hard to see that Novo Nordisk has become a giant in this space, pioneering first- and second-in-class GLP-1RA obesity medications. In 2021, the GLP-1 market was valued at $16.53 billion, with a compound annual growth rate of 6.1%, with the market size (across T2D and obesity) projected to be over $24 billion by 2027. Novo’s 2022 investor report saw an 84% growth in obesity-related sales between 2021 and 2022. Patient demand for these medications has increased to a point where Americans are raiding Canadian pharmacies for their supply of Ozempic. The company predicts approximately $3.75 billion in GLP-1RA sales in 2025.

Yet striking first does not always presage market dominance. Merck began trials of the HMG-CoA reductase inhibitor lovastatin in 1980, and won a historic approval in 1987-- showing the medication produced robust reductions in LDL levels. However, the drug was subsequently overtaken by Pfizer’s Lipitor (FDA-approved in 1996), which generated ~$100B in sales from 1992 to 2017. Recent data from Eli Lilly's tirzepatide, may present a serious challenge to Novo Nordisk’s dominant position in the anti-obesity space. Perhaps history is ripe to repeat itself.

Lilly’s seeks to SURPASS and SURMOUNT semaglutide

The only company to challenge Novo Nordisk in the GLP-1 RA space thus far has been Eli Lilly. Trulicity (dulaglutide), has held a steady and growing share of the market in GLP-1s for T2D (Figure 3). Yet it is Lilly’s newest drug, tirzepatide, which poses a more serious threat to Novo’s market dominance.

Identified as the first incretin in the 1970s (see section I), GIP has historically been thought to have little therapeutic potential. GIP showed a diminished effect in boosting insulin secretion in T2D patients, for reasons that are still not understood. Further, unlike GLP-1, GIP increases triglyceride storage in white adipose tissue, does not delay gastric emptying, and may impact bone remodeling--functions that were thought to limit GIP’s utility in T2D and weight loss. However Lilly’s demonstration that a GIP/GLP-1 receptor co-agonist (tirzepatide) has superior efficacy compared to selective GLP-1 receptor agonists, has renewed interest in the “first incretin.”

Lilly rolled out their SURPASS trials to position their agent amongst existing diabetes medications and GLP-1 agonists. Their first study assessed tirzepatide against placebo in patients with untreated T2D. Across the 40 weeks of treatment, weight loss ranged from 6.2 to 8.8 kg (greater than what was seen in early Phase 2 semaglutide trials) (NCT03954834). Tirzepatide was approved under the brand name Mounjaro for T2D in May 2022. The SURMOUNT-1 trial formally assessed weight loss of tirzepatide against placebo in obesity. The mean percentage of body weight loss at 72 weeks was 15.0% at the lowest dose, and 20.9% in the highest dose cohort (compared to 3.1% in placebo) (NCT04184622). This is a 6.75 fold increased in percent weight loss from highest dose to placebo, compared to the 5.9 fold increase seen in the STEP-1 trial.

Lilly recently announced that in Q1 2023 Mounjaro notched $568 million in sales. With obesity trials ongoing and an FDA-approval for this indication looming, analysts have predicted peak sales to balloon to a staggering $25B.

Ongoing tirzepatide studies in obesity

Lilly’s SURMOUNT-2 trial, estimated to read out in 2H 2023, will assess weight loss in patients with T2D. The SURMOUNT-3 trial will continue to assess weight loss in patients with a BMI >30 kg/m2 or with a BMI >27 with a weight-related comorbidity after intensive lifestyle and diet intervention and is expected to read out in 2H 2023 (NCT04657016). SURMOUNT-4 will address the question of weight regain after stopping the drug: patients who took tirzepatide for 6 months, will be assessed for sustained weight loss one year later (NCT04660643).

The SURMOUNT-4 trial presents another opportunity for tirzepatide to differentiate from Novo’s semaglutide. In March, Novo Nordisk announced that patients regained two-thirds of their weight one year after stopping semaglutide treatment. Sustained weight loss could make dual GLP-1/GIP receptor agonists more attractive to payers, and increase the affordability of these drugs for healthcare systems. Yet at this point, there is nothing to suggest that tirzepatide will have greater weight-loss durability.

In the SURPASS and SURMOUNT trials, Lilly has so far compared tirzepatide to older treatments or placebo (for T2D and obesity). However, Lilly recently (April 21, 2023) registered a new Phase 3b trial (SURMOUNT-5) that will compare Mounjaro against Wegovy in patients with obesity or overweight with weight-related health conditions. The trial aims to enroll 700 participants, and will run 78 weeks (estimated readout 1H 2025). The primary endpoint will be percentage weight changes between the two drugs at week 72 (compared to baseline). However, at this stage it’s not clear if SURMOUNT-5 is designed to detect Mounjaro’s superiority (rather than non-inferiority).

If the efficacy readouts from SURMOUNT-1 are reproducible, Lilly almost certainly has a best-in-class medication – this may be plainly reflected in the SURMOUNT-5 Phase 3b trial readout (1H 2025). How will Novo Nordisk reposition itself with this new competitor encroaching on their market share? Will tirzepatide cannibalize the entire GLP-1 RA T2D and obesity market? Are other dual-agonists in development as effective, and what factors (e.g., tolerability profile) may allow for competitive differentiation? Finally, what factors do we need to consider in our healthcare system to ensure that patients have appropriate (and likely chronic) access to expensive biologic medications?

4. Barriers to translation

There has yet to be a full accounting of the promise and price of GLP-1R agonists --only time will tell. Prior efforts to treat obesity demonstrate that sustained weight reduction is a Herculean task--thus it may be the case that GLP-1 agents will need to be administered chronically to sustain anti-obesity benefits. What are the possible drawbacks of taking GLP-1 or dual GLP-1/GIP agonists for 10 to 20 years? Do the benefits of weight loss--enhanced glycemic control and potential reduction in cardiac events--outweigh possible side effects of chronic treatment? What about the increased costs to our healthcare system? This section will briefly review what we know about the current safety data of GLP-1 and GLP-1/GIP agonists, and factors that may promote long term clinical use of these agents in obesity.

Side effects in long term trials

Though GLP-1 receptor agonist drugs like Wegovy and Ozempic may seem new to the public, these drugs have been tested in patients for decades.

People often say: ‘GLP-1 drugs are new medications. How do you know it's going to be safe?’ The truth is that these drugs have been evaluated in animals and patients for over 18 years—we know a lot about them. I don't see many remaining critical issues in terms of patient safety. — Dr. Daniel Drucker [Biomarker April 2023]

To date, the adverse event profile of GLP-1R agonists is characterized by relatively mild gastrointestinal (GI) side effects, such as nausea, vomiting, and diarrhea. Nonetheless, these symptoms led to discontinuation of treatment in 4-8% of patients enrolled in completed obesity trials for semaglutide (Novo Nordisk), and the dual GLP-1/GIP receptor agonist tirzepatide (Eli Lilly). Some GLP-1R agonists, such as Altimmune’s pemvidutide, can cause GI-related discontinuation rates as high as 12% (within 16 weeks). Big pharma has also hit this stumbling block—Sanofi’s shot on goal for a GLP-1 RA was halted in Phase 2 studies due to even higher GI toxicity.

Yet in most patients this GI distress is not severe enough to stop treatment, though it is reported in approximately 40% of patients (compared to 20% on placebo). Many of these side effects dissipate with chronic treatment; there is also data to suggest that slower titration regimens (employed in GLP-1-insulin combo therapies), may reduce rates of nausea and vomiting further. Nonetheless, future GLP-1RA that demonstrated reduced incidence of nausea and vomiting will have a significant competitive advantage in the market.

I do think tolerability of these drugs is still an issue. Some people can’t tolerate the mild nausea, diarrhea, and occasional vomiting. Though most of the time these side effects go away over a few weeks, it would be nice to have newer versions that were not as challenging to introduce. -- Dr. Daniel Drucker [Biomarker 2023]

GLP-1 agonists carry a black box warning for C-cell medullary thyroid cancer, an event that was noted in animal studies, but never in human patients in decades of clinical trials. In the Phase 3 trial of once-weekly semaglutide for weight loss, lean body mass decreased, but the proportion of lean body mass relative to total body mass with semaglutide remained stable (earlier trials of 3.0 mg liraglutide did not report lean body mass proportions).

What factors should we weigh in our consideration of the utility of GLP-1 agonists? At about a 3 year time point, semaglutide (Wegovy and Ozempic) appears to be a safe medication with relatively minimal GI side-effects. Risks of muscle loss, malignancy or prerenal acute kidney injury appear negligible from analysis of currently available datasets. The GLP-1R is expressed in many tissues, including the heart, brain, kidney, liver and immune system. Long term administration of agonists could potentially lead to unanticipated consequences in these organs. However, it is encouraging that preclinical and early human studies suggest that GLP-1 agonism appears broadly protective: indeed clinical trials of these agents are being initiated in cardiovascular disease (SELECT and SOUL trials, see below), NASH, and neurodegeneration (Alzheimer’s and Parkinson’s). Physicians will need to pay close attention to the unanticipated emergence of both negative and positive effects seen in patients that may remain on these agents for decades.

However, the immediate barriers to adoption of these drugs may lie not in their side effect profile, but rather in the ability of our physicians and healthcare system to accept them.

Costs on the US Healthcare System

GLP-1/GIP agonists have ushered in a new age in obesity therapeutics. Recently, Ozempic-hungry Americans have crossed the border to raid Canadian pharmacies for the medication (securing over 15,000 doses by some estimates). In the US, Wegovy is approved for use in individuals with a BMI over 30 with no other co-morbidities and 27 in individuals with a weight-related condition, such as hypertension.

Let’s do a back-of-the-envelope calculation. According to a 2022 Novo Nordisk Investor’s report, approximately 130 million Americans are eligible for a GLP-1 RA for weight management (BMI > 30, or >27 with a weight related comorbidity). Currently, approximately 40 million patients in the US have insurance coverage for Wegovy--30 million via commercial health insurance, and the remaining through Medicaid. Medicare does not currently cover obesity related medications--though drugmakers are furiously lobbying Congress for access to the 65 million older and disabled people insured through Medicare. With a price tag of $1300 per month, many GLP-1 receptor drugs could cost insurers and patients billions. With new data expected this month from the Lilly’s SURMOUNT-2 trial, analysts are predicting up to $52B in peak sales of tirzepatide (for T2D, obesity, and other indications); the total size of the obesity therapeutics market could swell to $100B by 2026.

Where will this $100B come from? What happens if GLP-1/GIP agonists become widely covered by commercial insurers or Medicare? Will the benefits outweigh the substantial price for patients and the taxpayer? From a cost-effectiveness perspective, these drugs would have to translate to striking long-term health benefits for patients, such as a reduction in major cardiac events or an overall increase in time to dialysis. What is the evidence that these drugs are “worth it” long term? Will this data be compelling enough to move payers?

These drugs may not be cost-effective. Rightly or wrongly, companies are aware that they can make a lot of money selling these drugs. I think cost [of GLP-1 drugs] will be an ongoing issue. — Dr. Daniel Drucker [Biomarker April 2023]

Can GLP-1/GIP therapies improve long term health outcomes?

Analysis of data from prior diabetes trials reveals that these agents seem up to the task. A composite analysis of 8 cardiovascular outcomes trials completed in 2021 demonstrated reduced incidence of major cardiovascular events by 14% and cardiovascular death by 13% (NCT01147250, NCT01179048, NCT01720446, NCT01144338, NCT02465515, NCT01394952, NCT02692716, NCT03496298). Nonfatal stroke risk was decreased by 16% and hospitalization for heart failure by 10%. The drugs also seemed to have a reno-protective effect, reducing the composite kidney outcome by 17%. Additionally, in a 72-week Phase 2 trial in patients with biopsy-confirmed NASH and liver fibrosis of stage F1, F2, F3. Between 36% and 59% of patients in semaglutide groups achieved NASH resolution with no progression of fibrosis (compared to 17% in the placebo group, NCT02970942). In an earlier 54-week study, 9 of 23 patients who received liraglutide had resolution of definite non-alcoholic steatohepatitis compared to 2 of 22 patients in the placebo group (NCT01237119). These results are compelling; future studies will shed light on whether semaglutide can compete (or synergize) with non-GLP-1 drugs like resmetirom (Madrigal, 30% resolution at 52 weeks), efuxifermin (Akero) and Lanifibranor (Inventiva) that are in late stage clinical testing for NASH. A key differentiator of Mardrigal’s resmetirom is that in a pivotal Phase 3 trial, it achieved both primary endpoints of NASH resolution and reduction in fibrosis (MAESTRO-NASH), the two liver histological improvement endpoints the FDA has proposed as reasonably likely to predict clinical benefit. Whether GLP-1/GIP drugs can impact fibrosis remains an open basic and clinical question.

Early trials, concerned about possible cardiac safety issues, were designed to ensure that GLP-1 use did not negatively impact cardiovascular outcomes. The first of a series of CVOT was the ELIXA trial, which compared patients with T2D and a history of a heart attack or unstable angina to either receive once daily injections of lixisenatide or placebo. When examining a composite cardio outcomes endpoint (death from CV disease, nonfatal myocardial infarction, nonfatal stroke, or hospitalization for unstable angina), the ELIXA trial suggested that GLP-1s did not increase cardiovascular event risk (hazard ratio of 1.02).

The 2016 LEADER (NCT01179048) trial was the first to demonstrate a modest cardiovascular benefit in patients with T2D and stable cardiovascular disease receiving liraglutide, when compared to placebo. Although designed for non-inferiority, the SUSTAIN-6 (NCT01720446) trial showed a 2.3% reduction in MACEs in patients with T2D in patients taking weekly injectable semaglutide. The EXSCEL (NCT01144338), HARMONY (NCT02465515), REWIND ( NCT01394952), and AMPLITUDE-O (NCT03496298) trials all demonstrated cardioprotection or near misses for exenatide, albiglutide, dulaglutide and efpeglenatide, respectively. These trials are mostly based on composite reductions in MACEs (similar to the original ELIXA trial endpoint).

The 2019 PIONEER-6 Phase 3a trial was a non-inferiority trial designed to test the cardiac and renal outcomes of patients with T2D receiving daily oral semaglutide. Though the trial was powered to only detect non-inferiority, the observed (non-significant) hazard ratio for semaglutide vs. placebo was 0.79--suggesting possible cardioprotection. Encouraged by these results, Novo Nordisk launched the much larger SOUL trial the following year. The trial currently has almost 10,000 patients enrolled and is expected to assess a composite MACE endpoint consisting of cardiovascular (CV) death, non-fatal myocardial infarction, or non-fatal stroke in patients with T2D as is expected to readout in July 2024 (NCT03574597).

The recently launched SELECT cardiovascular outcomes trial is the first of its kind—evaluating the cardiovascular benefits of weekly semaglutide in patients without diabetes but with a higher BMI (NCT03574597). It is still uncertain how long term health outcomes are improved in patients with obesity alone, and if previously observed effects are simply mediated by enhanced glycemic control. Prevention has often been lauded as the holy grail of pharmacologic treatment, with the power to curb rising healthcare costs and mortality rates. Mean MACE-related costs (for a first event) are estimated to be about $20,000 per patient. There are about 80,000 non fatal strokes and 605,000 first-time heart attacks in the US per year. Prevention of just 1% of these cases would save the healthcare system an estimated $13.8B. The SELECT trial is an important shot on goal to determine whether incretins have preventive power. Yet until patients and payers see these results (readout mid-2023), will they be able to stomach the cost of GLP-1 drugs? Will improvement in cardiovascular outcomes even be sufficient to reassure patients and payers on the value proposition of these drugs? If so, what magnitude of improvement in cardiovascular outcomes will be necessary to move the needle?

Many insurance plans will not reimburse drugs for obesity, because they view weight loss as a “lifestyle” choice. We need to prove that there is a long term health benefit for patients and the healthcare system. We don't have evidence of that yet. The SELECT trial will go a long way to answering: is there a real cardiovascular benefit? What is the number needed to treat? — Dr. Daniel Drucker [Biomarker April 2023]

5. Conclusion

GLP-1, the next PD-1?

When a novel therapy shows real promise of helping patients and garnering FDA approval, it is not long before other companies launch their own efforts. Approvals for the immunotherapies Keytruda (α-PD-1 mAb) and Kymriah (CD19 CAR-T) were turning points in the fight against cancer—these successes paved the way for dozens of other biotechs and large pharma to develop their own PD-1- or CD19-targeting agents.

With over 60 companies currently developing GLP-1 targeting agents (GlobalData), the “incretin treadmill” is running smoothly. If efficacious, these GLP-1 drugs will be prime M&A bait for large pharma looking to enter the obesity market. Differentiation amongst these agents is important, and there are several factors that will make assets from smaller companies attractive: 1) oral and infrequent dosing regimens, 2) ability to improve cardiometabolic outcomes along with weight loss, and 3) reduced GI side effects.

Amgen has developed a GLP-1/GIP drug that is given monthly, while Intracia is working on an agent that is injected every six months. Oral GLP-1 biologics (e.g., in early development at Biora and Viking) or small molecule GLP-1R agonists (e.g., Structure Therapeutics), will further improve patient adherence and facilitate clinical uptake of these medications.

Recently, Altimmune reported interim data for its weekly injectable GLP-1/glucagon dual agonist (pemvidutide) in a Phase 2 trial--disappointing levels of discontinuations sent the stock tumbling 55%. However, pemvidutide showed a NASH reduction signal (reduction in liver fat) in an earlier Phase 1b trial interim analysis. The future of pemvidutide (and by extension Altimmune) rests on future trials showing weight reductions that match Wegovy or replicating NASH improvement trends from the Phase 1b (no small feat).

Viking therapeutics recently posted strong weight loss data for its weekly injectable GLP-1/GIP drug (VK2735) in a small Phase 1 trial. Importantly, impressive weight reductions of 8% were observed after only 28 days, without any participant dropout due to GI side effects. High rates of attrition (12%) were observed in Altimmune’s trials, and 5% of patients on semaglutide discontinued treatment due to nausea, vomiting or diarrhea (with 25-44% of patients reporting symptoms). Ultimately, follow-on assets that are most successful will possess some combination of convenient dosing, demonstrated benefits on the liver/heart/kidney, and improved GI tolerability.

In the GLP-1 field, we have gone from twice a day, to once a day, to once a week to now once a month [Amgen]. Wouldn't it be great to eventually have a drug that is given once every six months? I think there are always ways to make medicines more effective—greater weight loss, greater hemoglobin A1c reduction, new indications, fewer side effects. But I think there are also many ways to enable a larger number of people to safely and conveniently access these medicines to improve their health. —Dr. Daniel Drucker [Biomarker April 2023]

Beyond the incretins

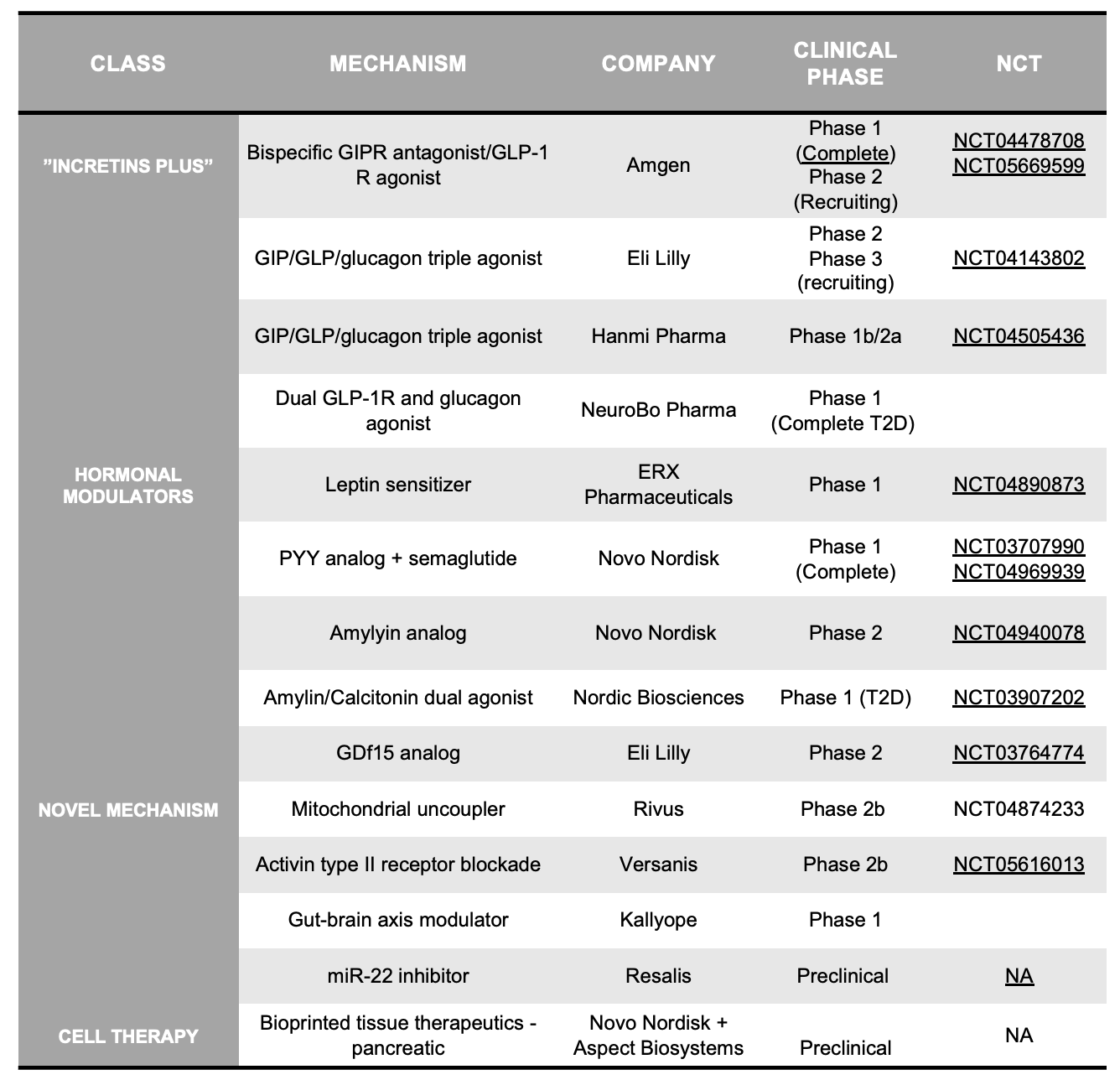

In our discussion, it is worth considering alternative therapeutic strategies. What other mechanisms may promote weight loss, and what factors would allow these agents to potentially compete with GLP-1 and GLP-1/GIP receptor agonists? Drug classes to be on the lookout for are outlined in Table 2, and include several major buckets:

Incretins “Plus”: these assets often add additional agonism to the classic GLP-1 or GLP-1/GIP drugs. These include GLP1/glucagon dual agonists (AstraZeneca, Boehringer Ingelheim, Hanmi Pharma, Eli Lilly) , GIP/GLP1/glucagon tri-agonists (Hanmi Pharmaceuticals, Eli Lilly), or solo GIPR agonists (Eli Lilly, Zealand Pharma). Lilly's next-gen Triple G (GLP-1/GIP/glucagon) agonist (Phase 1b, Phase 2): started recruiting for a Phase 3 trial this year — approvals are expected by 2026.

Hormonal modulators: buoyed by the success of therapeutically exploiting incretins, biotechs/pharma are exploring whether agonism of other GI hormones can similarly induce weight loss. These include leptin sensitizers, Y2R agonists (Eli Lilly, Novo Nordisk), amylin/calcitonin dual agonists (Nordic Biosciences, Amylin Pharmaceuticals), and ghrelin-targeting agents (Noxxon, Cytos)

Novel mechanisms: There are several companies taking differentiated (non-incretin) approaches to obesity. Companies in this space include mitochondrial uncouplers with enhanced safety profiles (Rivus, Continuum), GDF15 targeting drugs (Novo, Lilly, Janssen), anti- activin II receptor mAb (Versanis), mir-22 inhibition (Resalis Tx) and gut-brain axis modulators (Kallyope) . Rhythm Pharma is modulating the MC4R and POMC pathways in rare genetic (congenital) forms of obesity—though this work may not translate beyond these populations.

Cell therapy: regenerative medicine holds promise for many indications. Though early work from companies like Vertex (Semma Tx acquisition) are focused on regeneration of pancreatic islets (for diabetes), Novo Nordisk recently inked a deal (including $75M upfront) with early-stage cell therapy player Aspect Biosystems. Novo will get access to Aspect’s bioprinting technology and plans to use this 3D-tissue printing tech to develop up to four products for T2D and obesity. It is still too early to assess the promise of these cell therapy assets relative to semaglutide and tirzepatide.

An investment thesis for novel obesity therapeutics

Therapeutic strategies with novel mechanisms of action, rather than countless “me-too” incretin-based drugs, could lead to synergistic combinations and more durable treatments—as in traditional diabetes and heart failure management.

Outside of GLP and/or GIP receptor agonism, emerging novel strategies are largely preclinical or in Phase 1 studies. Substantial invested capital will be necessary to understand whether these novel targets and modalities will be successful in treating obesity. For any individual biotech company, an “investment thesis” encompasses much more (e.g. team) than just the pipeline and the underlying data. However, here, we focus solely on the key features we believe a differentiated therapeutic for obesity asset would contain.

In rough order of importance, a competitive novel obesity therapeutic would feature most, if not all, of the following:

Efficacy similar to that of tirzepatide: 21% of body weight loss at week 72 (SURMOUNT-1: >2,500 subject Phase 3, 15 mg dose). Weight loss above 15%, seen with Novo’s Wegovy (at 68 weeks), is the minimum bar.

GI tolerability exceeding current incretin therapies, particularly vomiting, which is a common reason for therapy discontinuance. Different mechanisms of action may elicit fewer GI adverse events, which are seen in ~40% of patients on semaglutide or tirzepatide.

Convenient administration—whether by a different route of administration (with small molecules & oral biologics favored over injectables), or dosing schedule (with infrequent injections being much better than weekly regimens). It is important to note that an impact of the Inflation Reduction Act is that small molecule therapeutics may continue to be deprioritized in favor of biologics, so development of oral biologics may (unfortunately) be more compelling for companies in this context.

Fat-selective weight loss would be an additional advantage, as the STEP-1 (NCT03548935) trial demonstrated that once-weekly semaglutide 2.4 mg resulted in 3.4 kg (7.5 lb) more loss in lean body mass compared to placebo. Thus roughly 40% of the total amount of weight lost on Wegovy was due to lean mass reduction. Causing fat loss while maintaining muscle mass would therefore be an attractive feature of a novel therapeutic (Versanis’ bimagrumab may be differentiated here).

The following features would enhance the value of an obesity therapeutic, but would likely be assessed in follow-up trials or even post-approval:

Additional efficacy in obesity-related co-morbidities. Semaglutide is less effective at reducing body weight in T2D patients compared to patients without (5% weight loss, SUSTAIN-6 and 15% weight loss, STEP, respectively). Tirzepatide is also less effective at reducing body weight in T2D patients compared to patients without (15.7% weight loss, SURMOUNT-2 and 22.5% weight loss, SURMOUNT-1, respectively). Agents that are as effective at weight reduction in diabetic patients, as well as those which add additional protection against related co-morbidities—NASH and cardiovascular disease--would be compelling.

Durability of weight loss after discontinuing therapy will be an important consideration. Early data from Versanis’ bimagrumab (anti-activin II) shows that patients maintain weigh and fat loss for 12 weeks after dose cessation. Durable responses could potentially i) improve tolerability by limiting drug exposure ii) facilitate convenient dosing schedules and increased patient adherence and iii) lead to lower long term costs on our healthcare system/payers.

Outstanding liabilities to consider during the development process and commercialization include:

Regulatory risk on the need for a cardiovascular outcomes trial. If the FDA will require outcomes trials for future approvals in obesity, this will add considerable time and cost to drug development. This highlights the importance of M&A for these emerging therapeutics in an investment thesis, as such trials are much more feasible for large pharma companies than for biotech startups.

Payer willingness to reimburse for weight loss therapeutics. Medicare does not reimburse for Wegovy and many private insurers follow their lead. Though Wegovy and Mounjaro clearly have been able to be commercially successful, additional entrants into the sector may struggle unless insurers in the US change their stance. Here, additional data on the preventive health benefits of treating obesity will be key (e.g., SELECT trial for semaglutide)

A company with asset(s) featuring compelling preclinical and clinical data demonstrating the above described profile could be positioned well to raise venture capital, even in today’s challenging private financing market, and attract M&A activity from giants like Novo Nordisk and Eli Lilly.

Final thoughts

The development of any therapeutic requires decades of foundational basic biology research, coupled with concerted efforts to drive those fundamental insights and translate them into medicines. The GLP-1/GIP incretins are no different: from their discovery nearly 40 years ago, to their recent FDA approval(s) in obesity, we have walked through the story of how this class of medicines has emerged and developed over time.

The rise of the incretin therapies for obesity has attracted tremendous interest, both from drug developers and prospective patients (consumers). Though we highlight the space as a promising area of focus for the future of healthcare, immense challenges remain before these drugs are effectively (and widely) integrated into routine clinical care. However, current and next-gen obesity therapeutics have the potential to vastly improve health outcomes; this necessitates continued investment in both the basic biology and translation of these agents.

The true impact that these drugs will have on our society remains to be seen. Yet one thing is abundantly clear: these agents have the potential to change how medicine is practiced.

Appendix (Tables 1-2 clickable links)